How to Read Vxx for Volatility Increase

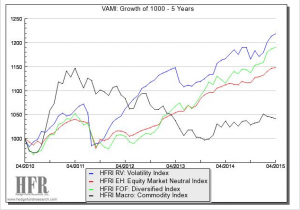

Volatility every bit an asset class has grown up over the fifteen years since I started my outset volatility arbitrage fund in 2000. Caissa Capital letter grew to about $400m in avails before I moved on, while several of its rivals have gone on to manage assets in the multiple billions of dollars. Back then volatility was seen as a niche, esoteric asset class and quite rightly then. Nonetheless, investors who braved the unknown and stayed the course take been well rewarded: in recent years volatility strategies equally an asset form have handily outperformed the indices for global macro, equity market neutral and diversified funds of funds, for case.

The Fundamentals of Volatility

It'southward worth rehearsing a few of the fundamental features of volatility for those unfamiliar with the territory.

Volatility is Unobservable

Volatility is the ultimate derivative, one whose fair price can never be known, fifty-fifty subsequently the outcome, since it is intrinsically unobservable. You lot can guess what the volatility of an asset has been over some historical period using, for example, the standard deviation of returns. But this is only an estimate, one of several possibilities, all of which accept shortcomings. Nosotros at present know that volatility tin can be measured with almost arbitrary precision using an integrated volatility estimator (substantially a metric based on high frequency information), only that does non change the essential fact: our knowledge of volatility is always field of study to uncertainty, unlike a stock price, for example.

Volatility Trends

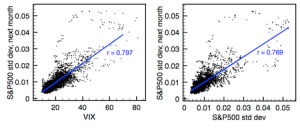

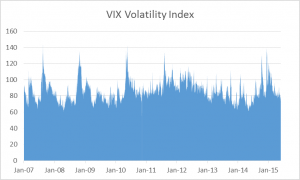

Huge effort is expended in identifying trends in commodity markets and many billions of dollars are invested in trend following CTA strategies (and, equivalently, momentum strategies in equities). Trend following undoubtedly works, according to bookish research, but is as well subject to prolonged drawdowns during periods when a trend moderates or reverses. Past contrast, volatility e'er trends. You lot can encounter this from the charts below, which express the relationship between volatility in the Due south&P 500 index in consecutive months. The r-square of the regression relationship is one of the largest to be constitute in economics.

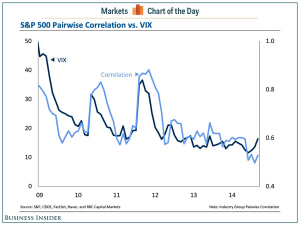

Volatility Mean-Reversion and Correlation

I of the central assumptions behind the ever-popular stat-arb strategies is that the footing between two or more correlated processes is stationary. Consequently, any departure from the long term relationship between such assets volition eventually revert to the mean. Mean reversion is likewise an observed phenomenon in volatility processes. In fact, the speed of mean reversion (as estimated in, say, an Ornstein-Ulenbeck framework) is typically an order of magnitude larger than for a typical stock-pairs process. Furthermore, the correlation between 1 volatility process and some other volatility process, or indeed between a volatility process and an asset returns process, tends to rise when markets are stressed (i.e. when volatility increases).

Another interesting characteristic of volatility correlations is that they are often lower than for the corresponding asset returns processes. One tin can therefore build a diversified volatility portfolio with far fewer assets that are required for, say, a basket of equities (see Modeling Asset Volatility for more on this topic).

Finally, more than sophisticated stat-arb strategies tend to rely on cointegration rather than correlation, because cointegrated series are often driven past some common cardinal factors, rather than purely statistical ones, which may bear witness temporary (see Developing Statistical Arbitrage Strategies Using Cointegration for more than details). Over again, cointegrated relationships tend to exist commonplace in the universe of volatility processes and are typically more than reliable over the long term than those found in asset return processes.

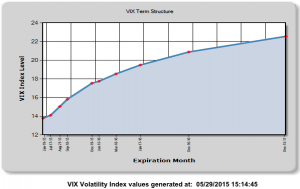

Volatility Term Structure

One of the well-nigh marked characteristics of the typical asset volatility process its upward sloping term structure. An instance of the typical term structure for futures on the VIX S&P 500 Alphabetize volatility index (every bit at the finish of May, 2015), is shown in the chart below. A steeply upward-sloping curve characterizes the term structure of equity volatility around 75% of the time.

The Volatility of Volatility

One feature of volatility processes that has been somewhat overlooked is the consistency of the volatility of volatility. Only on one occasion since 2007 has the VVIX index, which measures the annual volatility of the VIX index, ever fallen beneath 60.

Anything You Can Do, I Tin Do better

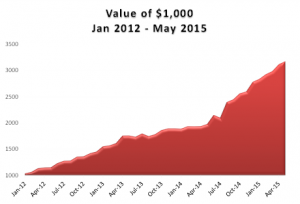

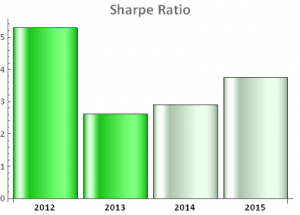

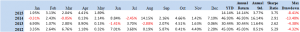

The take-away from all this should exist fairly obvious: almost whatsoever strategy you care to name has an equivalent in the volatility space, whether it exist volatility long/short, relative value, stat-arb, trend following or acquit trading. What is more, because of the inherent characteristics of volatility, all these strategies tend to produce higher levels of performance than their more traditional counterparts. Take as an example our ain Volatility ETF strategy, which has produced consistent almanac returns of between xxx% and twoscore%, with a Sharpe ratio in excess of 3, since 2012.

(click to enlarge)

Where does the Alpha Come From?

Information technology is traditional at this stage for managers to point the finger at hedgers as the source of aberrant returns and indeed I will do the same now. Equity portfolio managers are hardly ignorant of the cost of using options and volatility derivatives to hedge their portfolios; merely neither are they likely to be leading experts in the pricing of such derivatives. And, after all, in a year in which they might exist showing a 20% to 30% return, saving a few basis points on the hedge is neither here nor in that location, compared to the benefits of locking in the performance gains (and fees!). The aforementioned applies fifty-fifty when the purpose of using such derivatives is primarily to produce trading returns. Maple Leafage'southward George Castrounis puts it this manner:

Significant supply/demand imbalances continuously announced in derivative markets. The principal users of options (i.e. alimony funds, corporates, mutual funds, insurance companies, retail and hedge funds) merchandise these instruments to limited a view on the direction of the underlying nugget rather than to express a view on the volatility of that asset, thus making non-economical volatility decisions. Their determination process may be driven past factors that take zero to exercise with volatility levels, such as tax handling, lockup, voting rights, or cross ownership. This creates opportunities for strategies that merchandise volatility.

We might also point to another source of potential blastoff: the uncertainty as to what the current level of volatility is, and how it should be priced. Equally I accept already pointed out, volatility is intrinsically uncertain, existence unobservable. This allows for a disparity of views almost its true level, both currently and in future. Secondly, there is no universal agreement on how volatility should be priced. This permits at times a wide difference of views on off-white value (to give you some idea of the complexities involved, I would refer yous to, for instance, Range based EGARCH Option pricing Models). What this means, of grade, is that at that place is a basis for a genuine source of competitive reward, such as the Caissa Uppercase fund enjoyed in the early 2000s with its advanced option pricing models. The plethora of volatility products that have emerged over the last decade has just added to the opportunity set.

Why Hasn't It Been Washed Earlier?

This was an entirely legitimate question dorsum in the early days of volatility arbitrage. The price of trading an pick volume, to say null of the complexities of managing the associated risks, were pregnant disincentives for both managers and investors. Bid/ask spreads were wide enough to cause pregnant heads winds for strategies that required ambitious price-taking. Mangers often had to juggle two sets of risks books, one reflecting the market's view of the portfolio Greeks, the other the model view. The task of explaining all this to investors, many of whom had never evaluated volatility strategies previously, was a daunting i. And then there were the chapters issues: dorsum in the early on 2000s a $400m long/short choice portfolio would typically have to run to several hundred names in lodge to encounter liquidity and market touch on take chances tolerances. Much has inverse over the last fifteen years, especially with the advent of the highly popular VIX futures contract and the newer ETF products such as VXX and 14, whose trading volumes and AUM are growing rapidly. These developments have exerted strong downwardly pressure on trading costs, while providing sufficient capacity for at least a dozen volatility funds managing over $1Bn in assets.

Why Hasn't It Been Done Right Notwithstanding?

Again, this question is less rehearsed than information technology was 10 years ago and since that time there take been a number of success stories in the volatility space. One of the learning points occurred in 2004-2007, when volatility hit the lows for a 20 month flow, causing performance to crater in long volatility funds, as well as funds with a volatility neutral mandate. I think meeting with Nassim Taleb to discuss his Empirica volatility fund prior to that period, at the start of the 2000s. My advice to him was that, while he had some bully ideas, they were ameliorate suited to an insurance production rather than a hedge fund. A long volatility fund might lose money month afterwards month for an entire year, and with it investors and AUM, earlier seeing the kind of payoff that made such investment torture worthwhile. And so information technology proved.

Conversely, stories near managers of curt volatility funds showing superb functioning, only to blow up spectacularly when volatility eventually explodes, are legion in this field. Ane example comes to mind of a fund in Long Beach, CA, whose prime banker I visited with onetime in 2002. He told me the fund had been producing a rock-steady 30% annual render for several years, and the enthusiasm from investors was off the charts – the fund was managing n of $1Bn by then. Somewhat crestfallen I asked him how they were producing such spectacular returns. "They just sell puts in the S&P, 100 points out of the money", he told me. I waited, expecting him to continue with details of how the fund managers handled the enormous tail take a chance. I waited in vain. They were selling naked put options. I can only imagine how those guys did when the VIX blew upward in 2003 and, if they made it through that, what on earth happened to them in 2008!

Conclusion

The moral is uncomplicated: one cannot afford to be either all-long, or all-short volatility. The fund must run a long/short book, buying cheap Gamma and selling expensive Theta wherever possible, and changing the internet volatility exposure of the portfolio dynamically, to arrange current market conditions. It tin certainly exist washed; and with the new volatility products that have emerged in recent years, the opportunities in the volatility infinite have never looked more than promising.

Source: http://jonathankinlay.com/tag/vxx/

0 Response to "How to Read Vxx for Volatility Increase"

Post a Comment